US TARIFF ON CANADA, MEXICO, CHINA: A window of opportunity for Bangladesh

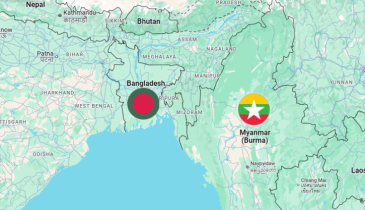

THE United States has implemented a series of executive order tariffs, effective from February 4, on key trading partners, including Canada, Mexico and China, as part of its broader trade policy agenda. Additional 25 per cent tariffs on Canadian and Mexican imports, whereas 10 per cent tariffs on Chinese goods are also imposed by US president Donald Trump. The orders are considered as bold steps to hold China, Canada and Mexico accountable for their pledges to curb illegal immigration and the flow of poisonous fentanyl and other drugs into the United States. These tariffs, aimed at protecting domestic industries and addressing trade imbalances, have had far-reaching consequences for global trade dynamics. One unintended beneficiary of these policies has been Bangladesh, which has seen an opportunity to enhance its export competitiveness in the global market. This article explores how US tariffs on Canada, Mexico and China have created a favourable environment for Bangladesh to expand its export footprint, particularly in the apparel and textile sectors, as well as leather and agricultural products.

US tariffs on Canada and Mexico

THE US imposition of tariffs on Canadian and Mexican goods, particularly vehicle parts, fruits, vegetables, spirits, beer, lumber, grains, potatoes, steel and aluminium, under Section 232 of the Trade Expansion Act of 1962, initially strained trade relations within North America. While the US-Mexico-Canada Agreement eventually replaced NAFTA and eased some tensions, the tariffs created uncertainty in the short term. This uncertainty prompted US importers to diversify their supply chains and reduce reliance on Canadian and Mexican manufacturers for certain goods.

For Bangladesh, this shift presented an opportunity. As a low-cost manufacturing hub with a strong focus on ready-made garments, Bangladesh was well-positioned to fill the gap. The country’s competitive labour costs, coupled with its duty-free access to the US market under the Generalised System of Preferences for certain products, made it an attractive alternative for US buyers. Additionally, Bangladesh’s growing expertise in non-traditional sectors like leather goods and footwear further enhanced its appeal as a sourcing destination.

US-China trade war

THE US-China trade war, marked by successive rounds of tariffs on billions of dollars’ worth of goods, has been the most significant driver of shifting global trade patterns. The US imposed an additional 10 per cent tariff on a wide range of Chinese products, including textiles, electronics and machinery, to curb China’s dominance in global trade and address intellectual property like Deepseek concerns. These tariffs disrupted established supply chains, forcing US companies to seek alternative sourcing destinations.

Bangladesh emerged as a key beneficiary of this realignment. As Chinese exports to the US become more expensive due to tariffs, global buyers will begin to shift their orders to other low-cost countries. Bangladesh, with its well-established RMG sector, is a natural choice. The country’s apparel exports to the US surged, as it offered competitive pricing and compliance with international labour and environmental standards. Moreover, Bangladesh’s focus on sustainable manufacturing practices resonated with US buyers seeking ethically produced goods.

According to a report on the Asian Development Bank, 2021, the trade war also accelerated the relocation of Chinese manufacturing units to Bangladesh. Facing rising production costs and tariffs, many Chinese investors turned to Bangladesh to take advantage of its low wages and preferential trade agreements. This influx of foreign investment has not only boosted Bangladesh’s export capacity but also facilitated technology transfer and skill development, further enhancing its competitiveness.

Prospects for Bangladesh

WHILE US tariffs on Canada, Mexico and China have created opportunities for Bangladesh, the country must address several challenges to fully capitalise on these developments. Infrastructure bottlenecks, such as port congestion and inadequate transportation networks, remain significant hurdles. Additionally, Bangladesh must improve its ease of doing business rankings to attract more foreign investment and diversify its export basket beyond RMG.

To sustain its export growth, Bangladesh should focus on innovation, value addition and compliance with international standards. Investing in technology and automation will be crucial to maintaining cost competitiveness as wages rise. Besides, the interim government needs to find long-term solutions for electricity shortages and banking sector concerns by forming the Export Development Fund to ensure sustainability in the export industry. Furthermore, the government should negotiate free trade agreements with key markets, including the US, to secure long-term trade benefits.

The US tariffs on Canada, Mexico and China have reshaped global trade dynamics, creating a window of opportunity for Bangladesh to enhance its export competitiveness. By leveraging its cost advantages, expanding its manufacturing capabilities and addressing structural challenges, Bangladesh can solidify its position as a preferred sourcing destination for global buyers. As the global economy continues to evolve, Bangladesh must adopt a proactive approach to trade policy and industrial development to ensure sustained growth and prosperity. In the end, we can expect that the impact of US tariffs has inadvertently boosted Bangladesh’s export competitiveness, underscoring the country’s potential as a strategic partner for global brands navigating an evolving trade landscape. -Source: new age

.png)