Bangladesh's Economy Needs Foreign Investment To Grow

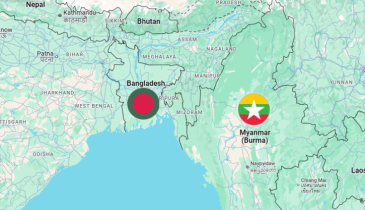

Bangladesh’s economy is at a pivotal moment, where the infusion of foreign direct investment (FDI) is not just desirable but essential for sustainable growth. As the country aspires to elevate its economic standing and improve living standards for its citizens, attracting FDI can serve as a catalyst for transformation.

Despite a 8.8% fall (from $1.6 billion in FY23 to $1.47 Billion in FY24), Bangladesh has earned the title of The Economist’s Country of the Year. The award recognizes significant improvement over the past year, particularly following following the rigorous regime change. However, to sustain this progress and attract foreign direct investment (FDI), Bangladesh must address existing challenges and create a more favorable environment.

The Current Economic Landscape

Recent forecasts by the World Bank indicate that Bangladesh’s GDP growth is projected to slow to 4% for FY25, down from earlier estimates of 5.7% due to political uncertainties and external pressures such as inflation and natural disasters. This decline marks a significant shift from the robust growth seen in previous years, where the economy expanded by 7.1% in FY22 post-pandemic. The economic environment is further complicated by a high inflation rate, 9.73% in FY24, impacting the cost of living and business operations.

The country’s GDP was approximately $437 billion in 2023 and is expected to reach $463 billion by the end of 2025. However, the private sector, which accounts for about 80% of GDP, faces numerous hurdles, including high interest rates and operational costs that stifle growth and investment. Inflow of FDI is what can give the private sectors a break through as it brings not only capital but also technology transfer, managerial expertise, and access to international markets. According to the United Nations Conference on Trade and Development (UNCTAD), FDI has been instrumental in propelling Bangladesh’s GDP growth, which has consistently surpassed 5% over the past two decades. This growth is particularly evident in sectors such as manufacturing, energy, and technology.

To rejuvenate its economy and achieve its Vision 2041 goal of becoming an advanced economy, Bangladesh must significantly boost FDI. In 2022, the country attracted only $3.48 billion in FDI, a stark contrast to Vietnam’s $19.74 billion and India’s $49.97 billion during the same period24. This discrepancy highlights the urgent need for reforms that enhance the investment climate.

Challenges Facing Foreign Investors

The landscape for foreign direct investment (FDI) in Bangladesh is hindered by several significant challenges that restrict its ability to attract considerable capital. A primary hurdle is the inefficiency within bureaucratic processes, which complicates the business climate. Bangladesh’s position in the World Bank’s “Ease of Doing Business” index is notably low, with investors often encountering intricate regulatory frameworks, delays in licence acquisition, and sluggish contract enforcement.

The Bangladeshi government has recognized the importance of FDI and has implemented various policies to attract foreign investors. These include tax holidays, duty exemptions on capital machinery imports, and profit repatriation facilities. Such incentives are designed to create an appealing investment landscape. However, while these measures are commendable, they must be complemented by broader reforms to enhance the overall investment climate.

Recommendations for Attracting FDI

To further attract FDI and stimulate economic growth, Bangladesh should consider implementing the following reforms:

Streamlining Regulations: Simplifying bureaucratic processes and reducing red tape will make it easier for foreign companies to establish operations in Bangladesh. Bangladesh still has nearly 100 EPZs to attract FDIs, which is of great resource for the country to lure investors.

Enhancing Infrastructure: Upgrading logistics and transport infrastructure is crucial. Many foreign investors cite inadequate facilities at ports and logistical inefficiencies as barriers to entry. Investing in infrastructure development—especially in transportation and energy—will improve operational efficiencies and lower costs for businesses.

Stabilizing Policies: Creating a predictable regulatory environment is vital. Frequent changes in tax rules have discouraged foreign investment; thus, ensuring consistency in tax policies and regulatory frameworks will build investor confidence and encourage long-term commitments from foreign firms.

Expanding Tax Incentives: Offering targeted tax incentives for industries with high growth potential can attract more foreign investment into critical sectors such as renewable energy and information technology.

Skill Development Initiatives: Investing in technical and vocational training programs tailored to industry needs is essential. Establishing training centers within Special Economic Zones (SEZs) would ensure that the workforce possesses the skills required by foreign investors.

Promoting Private Sector Growth: Encouraging private sector participation in developing economic zones can lead to faster growth and better service delivery than solely relying on public initiatives.

As Bangladesh stands on the brink of becoming a significant player in the global economy, it is imperative that the government prioritizes attracting foreign investment. The benefits of FDI extend beyond mere capital inflows; they encompass job creation, technological advancement, and enhanced productivity across sectors.

The government’s recent initiatives are commendable but must evolve into a comprehensive strategy that addresses both immediate concerns and long-term goals. The journey ahead may be fraught with obstacles, but with concerted efforts from all stakeholders—government, private sector, and civil society; Bangladesh can harness the power of foreign investment to drive sustainable economic growth. In doing so, Bangladesh can transform its economic narrative from one of stagnation to one of dynamic growth and development. The time to act is now—Bangladesh’s economic future depends on it. -Source: eurasia review

.png)